You wouldn’t bet on him to become an investor. Not really.

If you met him in a midwestern dive bar you might guess he was a local that fixed air conditioners for a living. His accent alone gave him away. His “O’s” were crisp. He’d say things like “Hoh abote we have a beer. You wuhnnu?”

No shirt and tie for him. He did wear a sleeve - a tattoo sleeve. Something he had done as a kid out of high school. He needed to use that combat pay for something. Without much guidance and with all the bravery of a testosterone-filled teenager, he had joined the Marines. He was 18 years old. It was 2001 and America was about to go to war. Nick Peters served his country proudly.

He came up in an 800 person town. A place where the per capita income is currently less than $20,000.

Put shortly, he had no head start.

But maybe the greatest advantage is no advantage at all.

If you met him in that sleepy bar, and sat next to him for a chat, you’d quickly realize this was no ordinary man.

He speaks like Hemingway writes - concise, straightforward, accurate. But these pedestrian words strung together paint a beautiful picture.

He’s one of the best investors I’ve ever met.

I used to think I knew more small companies than anyone else in America. Then I met Nick. He’s a walking encyclopedia of microcaps and business facts. If he pitches you an idea, you’ll want to buy it. Not because he’s a great salesman, but because his reasoning is ironclad. He can summarize a 50 page annual report in two sentences. He’ll tell you what matters, and he’ll be right.

If you asked him how he does it, he’d shrug and give you some half response. If you knew him well, you’d know the truth. He came from nothing. He knew nobody. Every dollar he wagered was a dollar he earned. He spent a decade digesting information about public companies. Companies that nobody else cared about. He was driven by two parts curiosity and one part necessity.

There was no safety net.

Setup

Nick called me one day in July 2021. He had been extoling the virtues of Singapore for a few months. Each time we’d talk he’d fill me in on some new fact about this prosperous nation.

Singapore is a society designed with well thought out incentives.

Singapore is well known for paying its political leaders very high salaries. This is done to prevent corruption. Pay your leaders so well that it would be crazy to take a bribe and undermine the well-being of the whole.

Organ donation is basically compulsory in Singapore. You can opt out, but you get pushed to the bottom of the list should you need an organ transplant.

Nick had been telling me about a few companies here. The market was small and cheap. There are only 5.6MM residents, a population smaller than New York City. There are currently 600 publicly traded businesses in Singapore. And the median market cap is $39MM. That’s a lot of small companies.

Nick wanted to tell me about a company he’d been buying - Azeus.

Azeus Overview

The best ideas are the ones that don’t screen.

Azeus had two business segments.

IT services business: This is what established Azeus long ago. It’s an “okay” business. It has gross margins in the 25-35% range. There were more years of profit than loss, but overall it wasn’t a great business.

Software: This was the engine that would propel Azeus’ success. In 2014, Azeus launched a software solution for boards of directors.

For the purpose of this write up we’ll only look at the software side of the business. The IT services business was moderately profitable, but the majority of intrinsic value was inside the software segment. This is what Nick would’ve focused on as well.

Valuation and Software Business

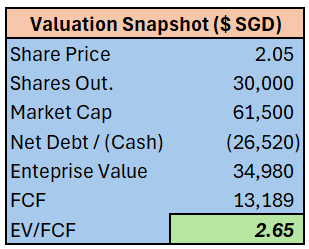

Nick called me in July 2021. Azeus’ full year numbers had been reported. This is how it looked at his cost basis:

Azeus was earning a nice profit and selling at a ridiculously cheap valuation. At less than 3x EV/FCF, the business seemed undeniably cheap. But it gets better. The software business was growing at a massive clip:

Azeus’ software product was a board portal. Board portals allow boards of directors to build meeting packets using a software solution. Board meetings have all kinds of sensitive data. For certain industries (banking, healthcare, education, etc.) a board deck can grow quite long. They’re often more than 100 pages. It’s tough for corporate secretaries to manage version control and security with physical documents or via traditional email.

The Azeus board portal product solves this issue. Board portals grew into a legitimate business in the early 2010’s as the tablet became increasingly more prevalent. By summer 20221, Azeus’ software product had been on the market for 6 years.

It’s important to note, the board portal software had very low churn. While the product wasn’t prone to seat expansion like some enterprise Saas companies, customers were very unlikely to rip it out once it had been installed. At the time, Azeus advertised on its website that 99% of customers renew annually.

Investors could be nearly certain growth would continue at some level.

Major companies, universities and nonprofits used Azeus’ products. And Azeus had a big advantage over its competitors. Most board portal companies are based in the western world. Azeus had a presence in Singapore and the Philippines. It had access to talented software developers in cheaper markets. An American competitor may have been paying several times more per year to retain software talent.

Since Azeus had a cost advantage, it could more easily scale its operation. It was arbitraging local labor prices and selling a product to large corporations with limited price sensitivity.

This cost advantage allowed Azeus to enter new markets quicker than competitors. While others were battling for customers in the U.S. and western Europe, Azeus was building out offices in Africa, South America and the Middle East.

And Azeus was doing all this while earning a profit.

Hidden Business

You don’t have to understand much to see why Azeus was a good business. A high margin, low churn operation was selling for less than 3x EV/FCF.

But why did the situation exist?

Remember, the best ideas are the ones that don’t screen. The fluctuations of the IT business masked the growth of the smaller and more profitable software segment. Here’s a look at the consolidated numbers from 2019-2021 ($ USD):

Revenues grew nicely in 2020, but 2021 was stagnant.

Operating income had hardly budged for three years.

Gross margin increases indicated that the business may be evolving, but that’s all you could see from the income statement. Investors screening for revenue or operating income growth would miss this opportunity.

The real story was in the cash flow statement. Accrual accounting can create a misleading picture in Saas businesses. In the case of Azeus, one look at the cash flow statement would prompt investors to dig deeper. Numbers again presented in $ USD:

Operating cash flow was significantly higher than operating income in 2020 and 2021.

Increases in unearned revenues were bringing cash into the business. There would be very little expense related to converting this unearned revenue. Gross margins on the software product were high.

Investors didn’t have exact figures on software gross margins, but data disclosed in the footnotes showed that the software segment was incredibly profitable, even when measured in accrual accounting terms.

These numbers are listed in $ HKD, I grabbed them directly from the 2021 financials.

I apologize for the changing currencies. But this presents yet another reason the business may have been hidden. The filings are in HKD, while the company is listed in Singapore, with a stock trading in SGD. Differing currencies can cause confusion for investors quickly screening numbers.

Wrapping Up

Nick built his position with a basis in the low $2.00 range. He called me in July. I thought this was a great idea. A brilliant guy found a brilliant stock.

I like the story of Azeus because it represents an opportunity in the recent past. Folks talk about Buffett buying Mid-Continent Tab Card and other cheap securities in the 1950’s. We’re often told that those opportunities are extinct. But Nick has proved that these things still exist. Nobody will tell you about them, though. You have to find them on your own.

Nick bought his shares in the middle of a stock market mania. He paid less than 3x FCF for a great software business while other investors were paying 30x sales for comparable companies.

The story of Azeus is a story of Nick. This opportunity shouldn’t exist. Great businesses don’t sell for this kind of price. It doesn’t happen. A guy with no pedigree and no opportunities shouldn’t become a great investor. An unlikely man found an unlikely business.

DISCLOSURE: THIS IS NOT INVESTMENT ADVICE. I MAY OWN SHARES MENTIONED IN THIS ARTICLE. I AM NOT YOUR FIDUCIARY. THIS IS THE INTERNET AND YOU’RE LISTENING TO A GUY NAMED DIRT.

Is there anyway to follow Nick?

Who is this mysterious nick?! Nice write up, just sub'd