Ted Weschler Case Study

Weschler Makes a Big Bet in the Depths of the Great Recession. Compounds at 52% a Year.

Ted Weschler turned $70,000 into $131,000,000 in 22 years.

That’s a 41% annual return. And he did it by owning nothing but publicly traded securities inside an IRA.

Weschler graduated from Wharton in 1983. He went to work for W.R. Grace in New York City at a salary of $22,000. Weschler’s salary deferrals along with employer matching and stock appreciation led to an account balance of $70,000 at the end of 1989. At that time he left W.R. Grace and began managing the IRA himself. Over the next 22 years Weschler grew the account at a 41% CAGR.

But the IRA was just a sideshow.

Quad-C

In late 1989, Weschler co-founded Quad-C. Quad-C mainly invested in private equity siutations, but also deployed capital in publicly traded securities. Weschler was tasked with deploying money in the public securities, where he had incredible success. Weschler made 20 investments over a 10 year period. He’s quoted as saying the following:

“19 of the 20 worked out really well. And I had a nice track record because of that.”

While the exact performance inside Quad-C isn’t publicly available, I’d assume Weschler drastically outperformed the market. If 95% of your ideas “worked out really well”, you’d have no choice but to destroy the index.

By 1999 Weschler was ready for a change. He left Quad-C and decided to spend his days exclusively focused on public securities.

Peninsula Capital Advisors

Weschler started Peninsula in January 2000. The stock market was at all time highs. In that moment value stocks were out of favor. The dotcom bubble was reaching unsustainably high valuations - investors were interested in eyeballs instead of earnings. Yet Weschler stayed committed to his value based strategy.

He managed Peninsula for 11 years before joining Warren Buffett at Berkshire Hathaway. In that time, the dotcom bubble burst and the world suffered through the Great Recession.

As one may expect, Peninsula outperformed. Here’s the track record over Peninsula’s 11 year life:

Peninsula Capital: 22.6% (Net of all fees)

S&P 500: 0.5%

Weschler’s track record from 1989 - 2011 can only be described as incredible. He turned $70,000 into hundreds of millions. He did it by taking concentrated bets in mispriced securities.

Today’s write up explores one of those bets.

Valassis Communications - Economic Overview

To set the stage - Weschler’s Valassis purchases started in 2008 and ended in 2010.

Markets were in free fall in the back half of 2008. The S&P 500 traded down 12% in the first six months of the year. This was already a blow to investors. But things were about to get much worse. In the second half of the year, the S&P would trade down another 26%. 2008 was the worst year for the S&P since the 1930’s. Investors were scared. The country was frozen.

I like to study news from that time. One of my favorite pieces is Warren Buffett’s interview on Charlie Rose on October 1st, 2008. Here’s a link to that interview:

You can see the flashes of concern on Buffett’s face throughout the interview - though he remains upbeat. He’s essentially doing the interview to encourage Congress to pass the Emergency Economic Stabilization Act. Congress passed the Act that evening.

Some of Buffett’s quotes from this recording:

“So this really is an economic Pearl Harbor. That sounds melodramatic, but I’ve never used that phrase before. And this really is one.”

Referring to Congress needing to act quickly: “And you better not spends weeks and weeks and weeks trying to assign blame or deciding on a complete plan for fighting the whole war, you know, and letting a committee decide where the battleships should go and all of that. You better spring into action with the best people you have.”

“I just worry about whether it’s enough. Every day that goes by, I mean, if you don’t react to Pearl Harbor for a week or two weeks or three weeks, you’re behind in the war that you otherwise would have fought. But it’s very important that the determination of the US Congress is focused to do what is is needed…”

So let’s just say people were scared.

Valassis Communications - Situation Overview

There was blood in the streets, no doubt, but market participants were getting the investment opportunity of a lifetime. Weschler bought the bulk of his Valassis shares in the 4th quarter of 2008.

Valassis was a direct mail marketing company. It made the coupons that come in the daily paper along with the other marketing material sent directly to your mailbox. Junk mail, basically.

But this junk mail has a reasonably high conversion rate. There’s a reason it shows up in our mailbox daily.

In early 2007, Valassis had purchased ADVO, the direct mail business. The purchase of ADVO doubled the size of the company, taking revenues from $1 billion to $2 billion. ADVO was acquired for $1.2B, financed almost entirely by debt. Prior to the ADVO acquisition, Valassis operated with only ~$115MM of net debt. Debt grew 10x over night. The company levered up - big time.

One more note on the issues of 2008. Valassis recorded a $245MM noncash goodwill impairment charge related to its purchase of ADVO. There were two main reasons for the write off:

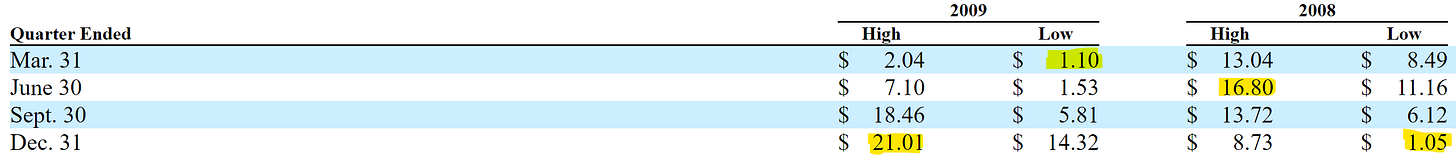

Valassis stock was destroyed in late 2008. Shares traded as high as $16.80 in the second quarter. At the lows of the fourth quarter, shares dipped to $1.05. A 94% drop.

ADVO was a capital light business. It had very little tangible assets. So when ADVO was acquired, most of the purchase price was recorded to goodwill. Any percceived dip in the future prospects of ADVO would result in goodwill impairment.

The combination of a large debt balance and a huge GAAP loss sent investors running the opposite direction.

Valuation

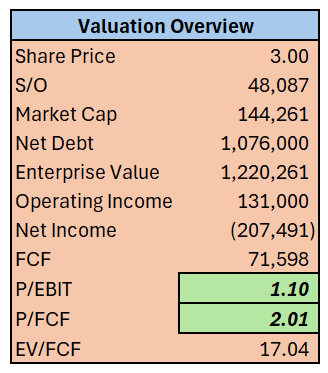

Weschler began buying in the fourth quarter of 2008. The stock price at that time ranged from $1.05 to $8.73. I don’t know exactly what he paid, but the stock fell hard on volume. Weshler was able to purchase 6.24% (or 3,000,000 shares) of the business in the quarter. We’ll assume he paid ~$3/share.

Valassis was trading at a ridiculously cheap price. This underscores how afraid investors were in the moment. At some point in the fourth quarter, shares dropped as low as $1.05 - meaning someone paid less than one times free cash flow for this business.

Debt Structure

Shares were cheap on a market cap basis, but when considering the heavy debt burden, they looked a lot more expensive. Let’s take a deeper look at the debt.

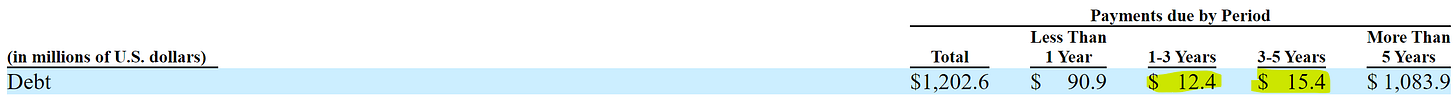

Nearly all the debt was in the two highlighted acccounts. The 8.25% Senior Notes weren’t due until 2015. So at the time Weschler was buying, he would’ve known the company had ~7 years before that debt was to be repaid/refinanced. The 2015 notes required no scheduled principal repayment prior to maturity.

Term Loan B carried a $458MM balance. It also had favorable terms:

Term loan B matured in 7 years, and required minimal principal payments. Here is a schedule of total debt payments required for future years:

Long story short, the business had 7 years of cash flow generation before it would need to reconsider its debt situation. EBIT, even in the depths of the recession, was enough to cover interest expense. At the end of 2008, Valassis was in compliance with all of its covenants.

On the Upswing

Weschler purchased another 1,000,000 shares in late 2009. I’ll assume he paid ~$17/share for his 2009 purchases. Have a look at the price history to see just how volatlie this period was:

In 2009, Valassis generated $183MM of EBIT and $178MM of FCF. The company used this cash flow to pay down $200MM of debt.

In 2010, Valassis generated $436MM of FCF (helped from a one time gain), and paid down $305MM of debt.

Crank Up That Buyback Machine

By the end of 2010 Weschler would’ve been up ~10x on his original purchases. The stock was approaching $40/share.

Valassis reinstated its stock repurchase program in 2010. That year it bought in 1.7MM shares at $33.57/share.

In late 2010, Weschler added another 800,000 shares to his portfolio. This time paying ~$33/share.

In 2011, the company spent $215MM on buybacks. That brought the share count down by a whopping 16%!

A Beautiful Cash Flow Statement

Here’s the cash flow statement from 2009 - 2011:

Operating cash flow is consistently positive.

There is minor capex, leaving loads of excess cash.

All free cash flow was used for debt repayment and stock repurchases.

How It Played Out

Let’s summarize Weschler’s purchases and basis - remember I’m using approximate numbers as I don’t know exactly what he paid:

In February 2014, Harland Clarke Holdings acquired Valassis for $34.05/share.

Weschler’s 2008 purchases would’ve compounded at a rate of 52.5% for a little less than 6 years. This is assuming he held his shares until the deal closed. Weschler is a long-term oriented investor, and I assume that was his goal.

The investment was a homerun.

What Did Weschler See?

We don’t know exactly what Weschler was thinking when he bought his shares. But I’d guess the combination of an extremely cheap price, favorable debt repayment schedule and consistent cash flow were the deciding factors. He increased his stake later, after it was clear that management was doing smart things with the cash flow.

It would be easy for an investor to misconstrue Valassis as a dying business. To be clear, its legacy inserts business was destined to shrink as physical newspaper circulation decreased over time. But the ADVO segment (Shared Mail below) was growing at a reasonable clip:

A theme that played out through the 2000’s and 2010’s was the disaggregation of media. In decades past, U.S. masses would watch Walter Cronkite deliver the news on a nightly basis. Folks read the local paper and maybe one or two national publications. This created a huge tailwind for any large consumer brand, as eyeballs were all gathered in the same place. Tide and Coca Cola could buy adspace during the 6:00 news, but no smaller brand was going to compete. The advertising budget simply wouldn’t allow it.

With the advent of the internet and the birth of distributed media, advertising changed. Consumers found themselves in deeper and deeper niches. Eyeballs were no longer concentrated in the same few spaces. For instance, you can spend an afternoon on Youtube watching someone install a stereo in a 1993 Subaru Impreza.

I remember listening to a Pat Dorsey talk a few years back. He made the point that Chobani and Dollar Shave Club couldn’t exist at scale 40 years ago. They would’ve never been able to afford the ad spend to get in front of enough eyeballs. It makes sense.

So maybe Valasssis offered one of the last remaining methods for brands to reach eyeballs in each household. It was the only way to ensure every resident in a zip code got exposure to a given company’s product. Whatever the case, the stock was plainly cheap.

Final Thoughts

In doing research for this piece, I went through a bunch of old files. While it has nothing to do with the write up, I feel compelled to say that Ted Weschler seems like a genuinely nice person. We know Buffett has a pretty strict policy on the type of people he will work with. Weschler is obviously a great investor. I’ll be cheering him on from the sidelines.

DISCLOSURE: THIS IS NOT FINANCIAL ADVICE. I MAY OWN SHARES IN THE BUSINESSES DISCUSSED IN THIS ARTICLE. I MAY BUY OR SELL SHARES AT ANYTIME WITHOUT INFORMING YOU. I’M NOT YOUR FIDUCIARY, ACCOUNTANT, ADVISOR OR PRIEST. SOME THINGS I SAY IN THIS ARTICLE MAY PROVE TO BE FALSE. THIS IS THE INTERNET AND YOU’RE LISTENING TO A GUY NAMED DIRT.

I don't care what anyone else says. The best part of this case study was: "For instance, you can spend an afternoon on Youtube watching someone install a stereo in a 1993 Subaru Impreza."

I wonder what the debt was trading at in the depths of the GFC