The best stock pitch I ever received came from an Italian college student.

It was a 160-year-old, super entrenched business selling for 1x EV/FCF.

I want you to read this story.

But more importantly, I want someone to recognize the great potential in this guy and hire him.

Back in January I got an email from a college student named Simone.

It was a simple pitch about a company called Gruppo 24 ORE (Ticker: S24).

S24 operates the leading business newspaper in Italy. Simone told me it’s the Italian equivalent of the Wall Street Journal. The business was formed in 1865, as Il Sole. In 1965, Il Sole merged with the number 2 business newspaper in Italy, 24 Ore. Post merger, there was no other business paper in Italy that could match its scale or brand reputation.

Today S24 has six separate business lines. Publishing, professional services, events etc.

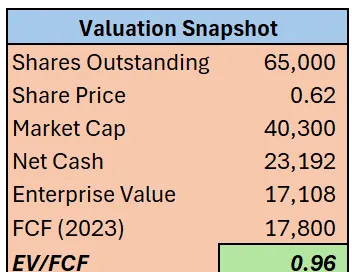

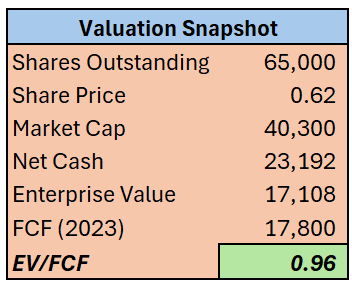

Here’s how the valuation looked when Simone pitched the stock:

Backstory

Here’s a 10 year chart of the stock:

What happened back in 2017?

Well, S24 had booked net losses for 8 consecutive years coming out of the Great Recession.

Then an internal investigation (spurred by a whistleblower report) found that management had inflated circulation numbers. Several members of the then management team were implicated - facing market manipulation and fraud charges. It was bad.

Responsible parties were dismissed and the stock got crushed.

Daily operations were unprofitable, and cash was dwindling.

To save the business, a €50MM stock issuance was completed. The combination of fraud implications, massive dilution and consecutive losses drove the stock down 99% from all time highs.

Corporate Structure

S24 has a unique corporate structure. There are two classes of stock - ordinary shares and special preference shares.

The shares basically have identical economic rights, though preference shares receive a slightly higher dividend if one is declared.

The ordinary shares are not traded. Public market investors own preference shares.

Now, the majority of the company is owned by a group called Confindustria. They have ~72% ownership.

Simone explained to me that Confindustria is somewhat similar to the U.S. Chamber of Commerce.

Basically, it’s an organization that exists to promote pro-business rhetoric across Italy. Confidustria is a nonprofit made up of 150,000 different Italian businesses who voluntarily opt in to further their own cause.

Confinudstria started the 24 Ore newspaper back in 1933, which later merged with Il Sole in 1965.

Working with a majority shareholder can be a blessing or a curse. It’s good to have someone with deep pockets if you enter a time of need. For instance, when S24 completed its equity raise back in 2017, Confidustria put up the bulk of the money. But it can cut the other way too. The majority shareholder could make a poor business decision and nobody can stop them.

Now, let’s take a deeper look at the business.

Turnaround and Expense Management

S24 got religion after its capital raise in 2017.

It sold unprofitable business lines.

Employee headcount was reduced by 30%.

In 2017, S24 generated negative operating cash flow of (€16MM). That number dwindled to (€8.6MM) in 2018. And by 2019, the business generated positive OCF of €13.5MM!

S24 booked positive OCF every year since 2019.

And better yet, each dollar of FCF was either used to pay down debt or retained on the balance sheet.

The business had significant net debt and delayed payables in 2017.

By the time Simone brought me the idea, S24 was sitting on $23MM of net cash. A sum greater than half its market cap.

Hidden Gems

Now this turnaround is all well and good, but I can still hear you saying “Come on Dirt, this is a dying business at the end of the day. Newspapers are toast.”

They may be.

Though I’d argue there is more staying power than you might think. 160 years is a long time to make things work. Any business living that long probably has more durability than we give it credit for.

Anyway, there was one segment that brought me great excitement. Look at this breakdown and see if you can guess:

The Professional Training and Services segment is earning 30% EBITDA margins!

This segment houses a wide variety of publications, databases and software for mostly white-collar professions. Accountants, lawyers, consultants, technicians etc.

For instance, one database product is aimed at providing updates on the rules and regulations around condominium construction. Another software product helps mayors and city councils prepare for audit. Another one assists you in tracking and complying with ESG mandates.

You can see how this would be a good business. Software and databases are some of the best businesses in the world. And a software aimed at only helping Italian local governments is unlikely to face major competition from abroad. Riches in the niches.

If you just throw the rest of the business away, you’d be paying ~1.5x EV/EBITDA for this segment alone.

Staying Power

When Simone pitched me the stock I had a couple thoughts.

I was immediately reminded of Moody’s during the GFC. The business did everything it could to kill itself, yet it’s still here and stronger than ever. S24 kind of gave me the same feeling.

I also thought about how insulated the brand must be.

S24 publishes Italian language news. The brand probably can’t extend much beyond Italy, but it’s also very unlikely to be disrupted by an outside publication.

Then there’s the moat around the database/software products. Again, a unique focus on Italian laws and regulations. It has zero value beyond its borders. But it’s unlikely to be disrupted by others.

The business was so cheap that I figured I could be wrong by a mile, and we’d still get paid.

The fundamentals of the business weren’t likely to interrupt our compounding.

It would probably be some outside force…

Take Private

On April 8th, Confidustria announced it would be taking the business private at €1.10/share.

On one hand, it’s a nice 77% return in just a handful of months for Simone and other buyers at €0.62. On the other hand, that’s an extremely cheap price.

I’m not sure if shareholders will push for a topping bid. I’m not an expert on Italian corporate law. Maybe S24 has a software product to get me up to speed…

I think the business is easily worth at least €2.00-3.00/share. But that happens sometimes.

Still, this was a 10/10 stock pitch.

Final Thoughts

In the few months I’ve known Simone, he’s pitched me a handful of stocks. They were all good ideas that he sourced on his own. Stable, cheap businesses.

When I asked him how he found S24, he said “I looked at every stock in Italy”.

That’s how you get ahead.

He’s smart - he knew net income was a useless metric. FCF mattered. D&A significantly outpaced capex. He was thinking like a businessman.

To the naysayers who think: “Well this works in tiny companies but we can’t buy something like that at my fund"

I’d like to counter that notion. If you’re young and broke and managing your own capital, you ought to be looking at stocks with tiny market caps. I’m completely certain it’s the best way for a young guy to get ahead in markets. So yeah, maybe you can’t buy the S24’s of the world. But it’s where Simone should spend his time.

I’m forever baffled at the stocks I see in fund letters. You know how many $20MM funds own NVDA and/or a bunch of other regurgitated Fintwit stocks? It feels like every damn letter I read some days.

I only have one filter when it comes to identifying smart investors: Do they have good ideas?

It makes the complex simple. It sums up game selection, valuation, durability, growth, work ethic in a five word question.

Simone has good, unique ideas.

It’s exceedingly rare to find someone who is willing to look at each stock on an exchange and also has the chops to separate the winners from the value traps.

He’s a young guy. He’s raw and smart and hungry as hell. I can only imagine what kind of investor he’ll be in 5 years’ time.

He speaks Italian, which is a giant advantage. I had him send all my questions to S24 management because he could more easily build rapport. He got responses from management that I would’ve never been able to dig up on my own. And I talk with a lot of management teams.

So…

I think someone should give this guy a shot.

Thousands of fund managers, HNWI’s and other investment related professionals will read this post. Someone ought to email him.

HERE’S HIS ADDRESS: si21.mazzarella@stud.liuc.it

Do me a favor. He’s going to get flooded with inbound. If you’re someone who just wants to shoot the breeze or share stock ideas, stay out of the way for a few months. Let Simone get the inbound he deserves. If you have something valuable to add, email him.

The Power of Writing

This story isn’t about me. It’s about Simone.

But I want to take a moment to further explain why you may want to consider writing.

I remember Dan Schum once saying that most of his ideas came from people who read his blog. They would just reach out and pitch him. Somehow, Dan cobbled together ideas (mostly from readers) and built a portfolio with a 30% CAGR over 12 years. Mind you, he was investing part time the whole way. Legend.

I’ve been writing on this platform for 14 months. In that time I’ve received at least 3 great stock pitches from subscribers.

Each pitch came from a different investor in a different walk of life:

An American hedge fund manager.

A retired bond trader.

An Italian college student.

Writing on the internet is an odd thing. You do your best trying to put something good into the world. And it seems to pay back 10x.

If the internet created infinite leverage, it also created near-infinite ROI on your actions. Do a little good, get a lot of good in return.

Now, let’s have someone do a little good for Simone.

DISCLAIMER: THIS IS NOT INVESTMENT ADVICE. I MAY OWN SECURITIES MENTIONED IN THIS ARTICLE. THIS IS NOT A RECOMENDATION TO BUY THIS STOCK OR ANY OTHER STOCK. I MAY BUY OR SELL ANY SECURITY AT ANY TIME. I MAY NOT TELL YOU IF AND WHEN I BUY OR SELL. THESE STOCKS ARE ILLIQUID AND YOU SHOULD UNDERSTAND THE IMPLICATIONS OF THAT IF YOU BUY THEM. THIS IS NOT TAX, LEGAL OR FINANCIAL ADVICE. I AM NOT YOUR FIDUCIARY. THIS IS THE INTERNET AND YOU’RE LISTENING TO A GUY NAMED DIRT.

Mitico Simone & mitico Dirt!