The Cheapest Stock Warren Buffett Ever Owned

Buffett paid 1x earnings and 45% of book value for a fast-growing insurance company.

Warren Buffett had a net worth of $19,700 in December 1951. That’s $230,000 in today’s dollars. His net worth had doubled that year, thanks largely to an investment in this little company called GEICO. But in 1952, Buffett found a security he liked even better than GEICO.

Buffett was 21 years old at the start of 1952. He had just graduated from Columbia Business School and was working at a 5-person brokerage firm in Omaha. This brokerage firm received annual volumes of the Moody’s manuals. These manuals were thousands of pages – packed with font out to the margins with statistics on ~10,000 businesses. Buffett said he read through each manual – twice!

The Moody’s manuals served as Buffett’s guide to his first $1 million. From 1952 to 1962, Buffett compounded his net worth at 48% per year. And the inspiration for most of these investments came from the Moody’s manuals.

Western Insurance Overview

Sometime in early 1952, Buffett was flipping through the Moody’s Bank and Finance manual when he stumbled upon Western Insurance Securities Co. Western Insurance was a holding company with two subsidiaries:

Western Casualty & Surety

Western Fire

Western Insurance Securities owned 92% of Western Casualty, which in turn owned all of Western Fire.

The combined entities wrote several lines of business, but automobile insurance made up more than 60% of the overall business. Premium data below is from 1953, but it’s basically the same as 1952. My 1952 data is blurry, and this is easier to read.

Revenue & Profitability

Buffett had the 1951 financial data when he began buying the stock. Here’s a 10-year history of net earnings leading up to 1952. Western was booking profits every year for a decade.

Buffett pulled the revenue growth and market share data from the time the company was formed (1924) through the date he purchased shares. He found that premium volume and market share were progressing rapidly.

Young Buffett pulled at least five years’ worth of combined ratios and compared those to industry standards.

Western was consistently profitable. The business had a long history of growth, and management had proven its ability to underwrite well. Combined ratios at Western Fire and Western Casualty were below the industry averages. This is impressive, especially given the growth in business over time. Management was expanding the business in a safe, profitable manner.

Balance Sheet and Capital Structure

My numbers aren’t perfect, but they’re reasonably close. My data is a little blurry, so I make the best I can with what I have. It doesn’t matter for our purposes -it’s close enough.

Just to rehash, Western Insurance Securities (left) owned 92% of Western Casualty (middle), which owned 100% of Western Fire (right). Buffett bought common shares of Western Insurance Securities. There were three classes of stock inside Western Insurance.

6% Preferred Stock: 7,000 shares outstanding; $100 par. Callable at $125/share. Entitled to a 6% dividend ahead of common and class A stock.

Class A Cumulative: 35,000 shares outstanding, Callable at $60/share. Cumulative dividends of $2.50/share.

Common Stock: 50,000 shares outstanding. This is what Buffett owned.

Valuation:

Common shares traded between $10 and $25 in 1952. It’s unknown how much Buffett paid exactly, but let’s be conservative and assume he paid $25/share. With 50,000 shares outstanding, Buffett was buying at a valuation of $1,250,000. That’s 1.3x 1951 earnings. Of course there were two classes of stock sitting ahead of Buffett, but the preferred shareholders were only entitled to $129,500 of cash flow per year (6% on $100 par for 7,000 shares of preferred = $42,000; $2.50/share on 35,000 shares for Class A = $87,500; total = $129,500). Western was generating enough earnings to cover the preferred/Class A dividends ~7x over. No matter how you slice it, Western Insurance was insanely cheap.

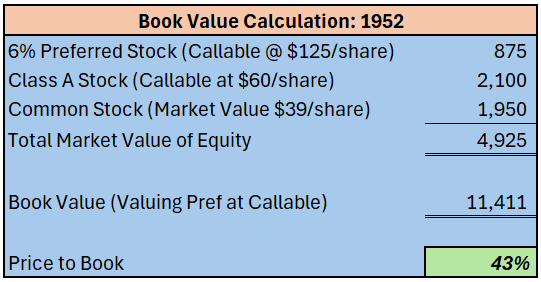

When considering price to book, Buffett looked at the preferred and class A shares in the most conservative way. Since these shares were callable, he valued them with the liquidation preference. In reality management would never call in these shares. Since the preferred and class A were getting such a small fraction of the earnings, and since earnings could be reinvested at high rates of return, paying off low cost capital would have a high opportunity cost. Buffett would’ve understood this, but just to be conservative, he valued the preferreds at callable price.

Buffett wrote about Western Insurance in “The Security I Like Best” in March 1953. By that time, the common stock was trading for $39/share. I reconstructed his narrative and backed into how he thought about book value.

Remember, this is price-to-book at $39/share. Buffett wasn’t paying more than $25 for his shares. Based on 1952 book value, Buffett paid closer to 37% of book.

Managing Its Investments

By 1951, Western had accumulated $23MM of investable assets. Buffett notes that the business followed an extremely conservative investment policy. Western relied on the growth in premiums to expand its investment empire – it wasn’t taking big risks on the investment side to grow its business. At year end 1951, ~$20MM of its investments were in government and municipal bonds. In 1952, Western earned $600K of investment income, which was plenty to pay preferred dividends of $130K. Buffett notes this in his memo. It seems to be the way he thought about the preferred shares. They have a small drag on the investment income, but that investment income is continuously growing, because premium volume continues to grow. It’s safe to say Western wasn’t overworking its investment capital to drive intrinsic value growth.

Why Was It Cheap?

Western Insurance was likely cheap for a few reasons. For starters the market cap for common shares was $1.25MM when Buffett built his stake. That’s ~$14.5MM in today’s dollars. Western was a tiny business. Tiny businesses get overlooked. Western traded over the counter. I have never seen an annual report for Western Insurance from the early 1950’s. I compiled my data by reading old Moody’s manuals. I would guess the business was unknown to most of the investing community.

There were 311 shareholders of common stock in 1952. I’m not sure if shareholders were aggregated at brokerage houses in those days, but at most, the average shareholder owned ~$4,000 of stock. There is no way Western Insurance was making headlines in the Wall Street Journal.

I think the preferred share structure may have also kept the common shares cheap. Investors may have viewed the preferreds as an additional complication in valuing the business. In the case of Western, the preferred shares significantly reduced earnings to common stock in the early days. It was only when the business grew premium volumes to an adequate level in the late 1940’s that the profits became material to common shareholders.

Lessons Learned

Buffett said he felt like he was going crazy at times. He would find these insanely cheap stocks. He’d try to get his clients to buy the stocks and they’d look at him like he was crazy. He tells the story of Kansas City Life Insurance (still around on the OTC today) selling for less than 3x earnings. Buffett thought that he could surely convince the local Kansas City Life agent to buy the stock. The agent would’ve understood the returns implicit in buying a life insurance policy. Buffett goes to the agent’s office, and says “here, why don’t you buy some shares of this company you work for, that you rely on to feed your family? The implied yield is 35%, that’s 10x better than the policies you sell to people!”

And the agent looked at Buffett as if he were speaking another language.

This phenomenon would continue. In the early 2000’s, Buffett invested almost all of his personal money in a bunch of Korean stocks. He deployed $100MM on a Sunday afternoon just flipping through stocks and buying simple businesses at 2-3x earnings.

How It Played Out

After Buffett wrote about Western in March 1953, the stock ripped up to $65/share. Within his first ~18 months of ownership, Buffett was up 160% on the stock. We don’t know when exactly he sold, but I think it’s safe to say he made a fantastic return. Buffett sold his GEICO shares to buy Western shares. At yearend 1951, GEICO made up ~65% his net worth. Knowing this, I’d assume Western was a huge position – likely greater than 50% of his portfolio. Western Insurance was acquired in 1984. Split adjusted common share value prior to acquisition was $1,030/share. This is after Western had reduced its ownership stake in subsidiaries. Dividends on common shares in 1979 alone totaled $2.1MM, nearly double what Buffett bought his stake for.

These Opportunities Are Gone

I can hear you, reader. I can hear what you’re saying right now. “Dirt, those days are over. Stuff doesn’t trade like that in the modern world.”

This was the best investment Buffett had ever seen. It wasn’t like he came across these sorts of ideas once a month. He found Western Insurance after looking through thousands of securities. So, there aren’t going to be 100 ideas that trade at this kind of price.

But maybe I can show you one idea from recent history.

In 2016, a full-time engineer and part-time investor named Dan Schum wrote a blog post about a stock he owned called Sonics and Materials (Ticker: SIMA). SIMA made ultrasonic equipment and had been in business for 50 years. The business had $13.5MM of net cash, was earning ~$2MM per year, and had a book value of $22MM.

What would you pay for that? Name a fair price. Now name a good price. Now name an egregiously good price. What did you come up with? $15MM? $13MM? $10MM?

Dan wrote about the stock when it had a market cap of $2.3MM.

Dan discovered the stock at $0.65/share. Management took the company private at $10/share five years after his writeup.

Here’s a link to Dan’s write up:

There are fantastic opportunities available to hard workers with small wallets.

Great story Dirt! Loved reading it!