Someone turned $450,000 to $2,700,000 in minutes.

That’s a 500% profit.

He took no risk.

He paid 3.9x earnings and 33% of book value for a high margin business.

A business that has been cranking earnings for 130 years.

This is the wildest arbitrage story you’ve ever heard.

In June 2024 someone bought 4,800 shares of Middlesex Water Co. Preferred shares (Ticker: MSEXP).

Middlesex is a water company that operates in New Jersey and Delaware.

It was formed in 1869.

The preferred shares have been outstanding since at least 1910, though they were probably issued when the business was started. Preferred shares have no par value, and are due a cumulative dividend of $7.00/year.

Preferred shares have been paid a dividend every year since at least 1912.

Pretty stable cash flow.

But there’s one more wrinkle in the preferred shares.

They are convertible. Every share of preferred stock is convertible to 12 shares of common stock.

From the 2023 Annual Report:

“The conversion feature of the no par $7.00 Series Cumulative and Convertible Preferred Stock allows the security holders to exchange one convertible preferred share for twelve shares of the Company's common stock.”

Here’s the kicker.

MSEX common shares were trading for ~$50 at this time.

And this guy bought 4,800 preferred shares for $95.

Meaning, every $95 spent on a preferred share, could be converted into $600 worth of common stock!!

Unbelievable.

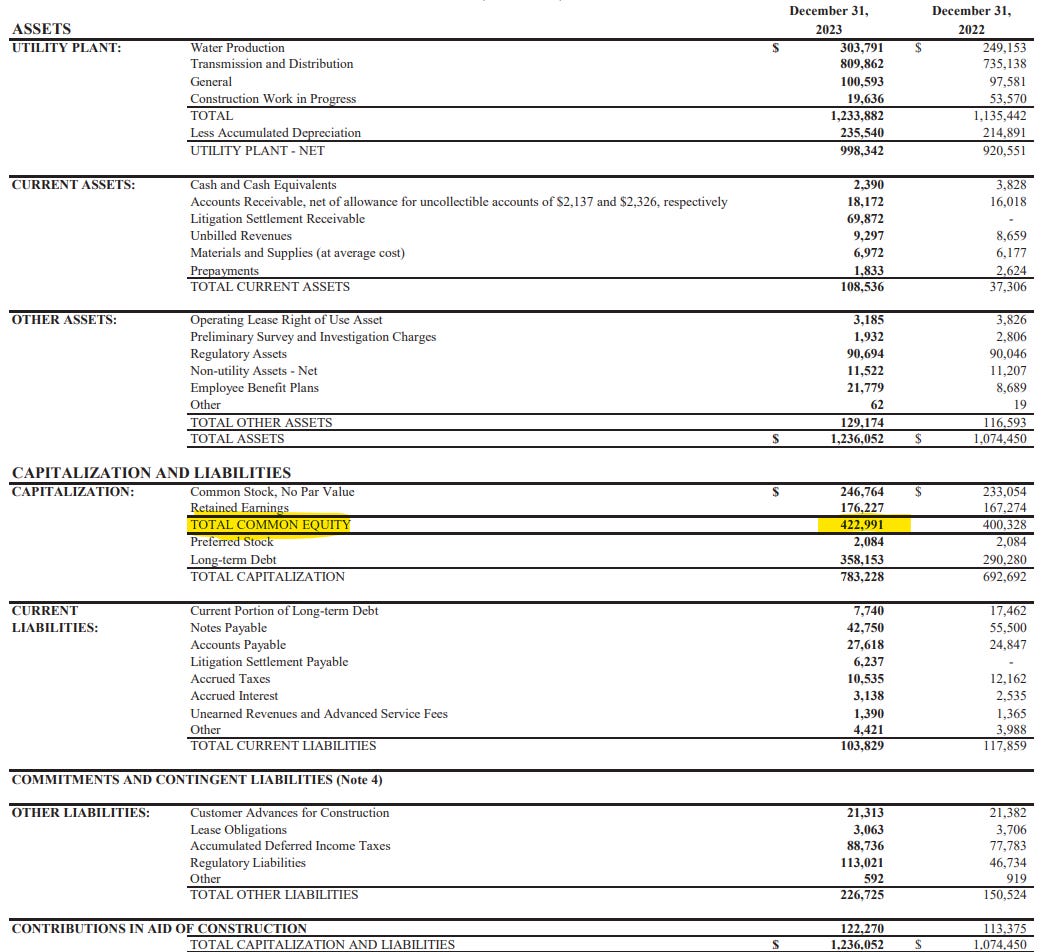

Middlesex Financials

So, what’s the deal with MSEX?

Was the common stock wildly overvalued? Was the preferred cash flow in jeopardy?

Let’s have a look at the numbers.

Remember, our buyer paid $95 for his prefs. This would value the converted common at $7.91/share ($95 divided by 12 common shares).

There are 18MM fully diluted common shares outstanding.

So our buyer effectively created a market cap of $142MM at his time of purchase.

Based on the 2023 annual report our buyer was paying 4.5x earnings and 34% of book.

Based on TTM numbers at the time of purchase, our buyer paid 3.9x earnings and 33% of book.

To the best of my knowledge, Middlesex has never reported a year of net losses.

They’ve paid a dividend every year since 1912.

Operating margins have been around 25% forever.

Our buyer took virtually zero risk when he bought his shares.

(In)efficient Market Theory

So why did this happen?

Because anomalies exist in public markets. You’ll see things that could never occur in a privately negotiated transaction.

The MSEXP seller probably had no idea what they owned.

Prior to last summer, the stock hardly traded in 20 years.

Things like this happen from time to time. They don’t make sense.

I don’t know what happened to our purchaser of the shares. I don’t even know who he or she is.

In the Q3 2024, someone converted 1,849 prefs into 22k common shares. So the company honored its commitment.

Maybe our buyer held, maybe he sold in a few days.

Regardless, I think it’s safe to say the buyer at $95/share was taking almost zero risk with enormous, guaranteed upside.

Final Thoughts

I believe someone managing a million dollars today has a similar opportunity set to what Buffett had in the 1950’s.

I catch a lot of hell for saying that. But I’ve found it to be true.

You can argue. You can say we have it harder now. That this MSEXP case is just a one-off. It’s an anecdote. It doesn’t count.

Okay. But I make a living buying the one-offs. The unknown. I go find some piece of publicly available information that nobody has. And I make money from it.

Here’s a tweet storm I wrote a few weeks back, kind of encapsulating the process:

The point is you get ahead by having a thin wallet and endless curiosity.

Buffett said it himself. He’s always defended the “earning 50% a year with a million dollar portfolio” quote.

I thought he gave his best response to the question at last year’s annual meeting:

There’s your answer.

Go look at every company on an exchange.

Learn everything about small companies.

There are bargains hidden in plain sight.

I’m going to run a series of “inefficient market” stories over the next few months. Email or comment if you have any interesting stocks you’d like me to cover.

DISCLAIMER: I DO NOT OWN SHARES OF MSEX OR MSEXP. I HAVE NEVER OWNED SHARES OF MSEX OR MSEXP. THIS IS NOT INVESTMENT ADVICE. THIS IS NOT A RECOMENDATION TO BUY THIS STOCK OR ANY OTHER STOCK. I MAY BUY OR SELL THESE OR ANY OTHER SECURITIES AT ANY TIME. I MAY NOT TELL YOU IF AND WHEN I BUY OR SELL. THESE STOCKS MAY BE ILLIQUID AND YOU SHOULD UNDERSTAND THE IMPLICATIONS OF THAT IF YOU BUY THEM. THIS IS NOT TAX, LEGAL OR FINANCIAL ADVICE. I AM NOT YOUR FIDUCIARY. THIS IS THE INTERNET AND YOU’RE LISTENING TO A GUY NAMED DIRT.

Dirt. Curious to know if you heard about this anecdotally, or if you pulled on the thread after seeing that someone had converted their preferred's, and worked backward into the realization that way.

Was hoping for the twist at the end that you were the buyer!