Warren Buffett Case Study - Greif Bros. Cooperage 1951

What do Warren Buffett, Forrest Gump and Phil Carret have in common?

Warren Buffett is the Forrest Gump of investing. His life seems to cross paths with every notable investor and operator. Think about it:

His partner, Charlie Munger, was a genius that grew up in the same sleepy midwestern town as Buffett.

He became the star pupil of the Ben Graham – the father of value investing.

When Buffett was 10 years old his dad took him to the New York Stock Exchange. Buffett met Sidney Weinberg, the leader of Goldman Sachs. Six decades later Buffett would help stabilize Goldman in the 2008 crisis with a $5 billion investment.

His neighbor in the 1950’s, Don Keough, worked his way up from a lowly coffee advertiser to become President of Coca-Cola. Then Buffett became Coke’s largest shareholder.

He bought the largest home furnishing store in the world in his own backyard from a woman who could not read or write.

He shows up on the door of GEICO one Saturday morning in 1950. The CEO invites Buffett into his office to explain the insurance business. Buffett buys $13,000 worth of stock. Later in life he buys the entire GEICO operation, which is worth many billions of dollars today.

Forrest Gump thought he owned a fruit company called Apple. Buffett is the second largest shareholder in Apple today.

Forrest Gump’s drill sergeant proclaimed “Gump! You’re a G**damn genius!”. Of course the fictional Forrest Gump was the opposite - a well-meaning, low IQ guy that happened to achieve great things.

The difference - Buffett actually is a G**damn genius.

The Setup

Buffett bought shares in Greif Bros. Cooperage in 1951. Greif made barrels and containers for bulk packaging. A cooper is someone who makes wooden barrels - I had to look it up. In 1951 the business had 239 plants, including sawmills and cooper shops.

I don’t know how Buffett found Greif. In the mid-1940’s the legendary Phil Carret traveled to Omaha to meet a stockbroker named Howard Buffett (Warren’s father). Phil Carret started one of the first mutual funds in the United States. Howard recommended Greif to Carret, and Carret bought shares. Later in life, Warren Buffett would say that Carret “had the best long term track record of anyone I know”. Carret would become a shareholder in Berkshire Hathaway.

Another Gump-like moment.

So maybe Buffett got the idea from his dad. Either way, by 1951 he was interested enough to make Greif an 18% position. He owned $3,650 of stock, and his total net worth was $19,738 at the time.

Valuation

Greif had two classes of stock – Class A and Class B. Buffett owned the Class A shares.

Class A: Has preference in assets and cumulative dividends up to 80 cents/share. Participates 2:3 in dividends after Class A and B dividends have been paid. No voting rights. 177,000 shares outstanding.

Class B: Entitled to dividends equal to 40 cents/share after the class A dividends have been paid. Participates 3:2 in dividends after Class A and B dividends have been paid. Sole voting power. 156,000 shares outstanding.

Without getting too far into the details, Class A and B are basically just common stock. Class A gets paid first, and then B gets paid. As a minority shareholder, the A’s were a better bet given Greif’s earning power at the time.

There were a total of 333,000 shares outstanding between A and B. In 1951 the A shares traded between $13.37 and $19.50. We don’t know exactly what Buffett paid, but at year end, his records reflect shares held at $18.25. We’ll use that as his basis.

Class B shares didn’t have a quoted market. While the B’s had voting rights, the economic rights were worse. I’ll value both classes of stock at $18.25 for simplicity, though I believe the A’s were worth more.

The market cap at Buffett’s time of purchase was $6,077,250.

Financials

Here are numbers from 1950, the most recent financials Buffett would’ve had when buying the stock.

As we can see, Greif earned $1.6MM in 1950. This means Buffett was buying shares at 3.7x earnings!

Greif had a healthy balance sheet. Current assets are well in excess of total liabilities.

Greif was a net-net. Net current asset value was $6.8MM, against a market cap of only $6.1MM.

I’d estimate Greif to have ~$2MM of net cash. There was ~$1MM of debt.

U.S. notes are held for the payment of taxes, so I’ll exclude that from my net cash calculation.

Enterprise value was ~$4.1MM. Shares traded at only 2.5x EV/Earnings!

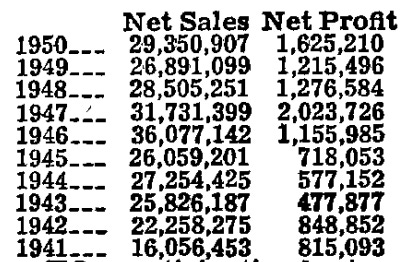

In addition to the strong balance sheet and cheap multiple, Buffett saw a long history of profits. Here’s a breakdown of sales and profit for the 10 years leading into 1950:

Greif had been profitable for at least a decade. Sales and profits slowly inched up as the years passed.

How It Played Out

I don’t know when Buffett sold his shares. He had a tendency to turn shares quickly in those days, as he had more ideas than capital. Buffett said that he visited Greif’s headquarters and met with its chairman in 1956, as he was moving back to Omaha from New York. He said he was still interested in the company at that time. I’m not sure if that means he owned the stock continuously up until 1956, or if he sold and was interested in buying again.

Greif is one of those businesses that seemed perpetually cheap. In 1952 and 1953, the stock traded as high as $19/share. In 1954 shares touched $25. In the few years after his original purchase Buffett had opportunities to sell at a handsome profit. Shares got up to $66.50 in 1960. My guess would be that Buffett made money but underperformed his CAGR for the time he owned it. Remember, he was compounding his capital well above 50% per year in those days.

Greif was so sleepy. It was not at all promotional. When he bought the stock it was priced as if the company were dead. But it was just the opposite. It was a simple business with a fortress balance sheet and long history of profitability. Greif was a microcap. Its inflation adjusted market cap was only $72MM when Buffett bought his shares. Plus Buffett was going to clip a 6% dividend yield on the stock.

Lessons Learned

My main takeaway here is to buy decent businesses at good prices. I know Buffett says he’d rather own a wonderful business at a fair price, but that’s because he’s already rich. When he had small money he was doing these kinds of deals left and right. Buy things that are easy to understand and clearly mispriced. Some will work wonderfully, some will work decently, and some won’t work at all. But that’s okay - you’ll still have a good batting average.

I’m reminded of another Buffett investment from his younger years. He owned shares of Merchants National Property. Merchants owned a bunch of real estate in the New York area. The business sold far below the value of its assets. Merchants is still around today. The ticker is MNPP.

Buffett sold his shares in MNPP to Walter Schloss. This was done as a “thank you” to Schloss. Schloss had sold his Dempster Mill stock to Buffett when Buffett was pursuing his activist campaign at Dempster.

Here’s what Schloss had to say about MNPP in 2006:

Anyway, MNPP shares trade for $1,489 today. Readers should go look at the stock. It trades at ~4x look through EBITDA on its properties. The business has a $135MM market cap. It’s sitting on $70MM of cash and securities (post-tax value). There is a mountain of equity in its properties today. The business trades at 66% of book value, but book value drastically understates the actual value of the business as several of the RE assets have been owned for a long time. Shares currently pay a 5.4% dividend yield.

Someone wrote up MNPP on Value Investors Club a couple years ago. The write up does a good job explaining the business. In response to the writeup a commenter responds and claims that the board turned down a $4,000/share takeover offer several years ago. I don’t know if that’s true, but the commenter certainly seems to know a lot about the business. $4,000+ would seem to be a more appropriate valuation today based on “back-of-the-napkin” math.

Here’s a link to the VIC writeup: MNPP Write Up - VIC

I don’t own MNPP, and I’m not recommending that anyone buys the stock, I’m just saying it’s a nice present day example of what Buffett liked to own. Like Greif, MNPP is pretty apparently mispriced. There is no real catalyst, and owners get a nice dividend each year. If I had to throw money into a stock for 10 years and walk away, something like MNPP would be a good candidate. You won’t make 50% per year owning MNPP, but I’d bet you outperform the market over a period of decades.

Companies with a steadily increasing intrinsic value and a reasonable capital allocation strategy, when purchased at a material discount to intrinsic value, will outperform.

Final Thoughts

Greif is still around today. Shares trade under ticker GEF and the market cap is currently $3.2 billion. We don’t know how much Buffett made on the stock. But we do know what Phil Carret made. At Howard Buffett’s recommendation in the 1940’s, Carret bought Greif shares at a split-adjusted price of $0.68. Carret lived to be 101 years old. He died in 1998. At the time of his death he still owned 4% of Class A Greif shares, which traded at $36.50.

DISCLOSURE: NOT FINANCIAL ADVICE. I’M NOT YOUR FIDUCIARY OR YOUR ADVISOR. I MAY OWN SECURITIES DISCUSSED IN THIS ARTICLE. THIS IS THE INTERNET AND YOU’RE LISTENING TO A GUY CALLED DIRT.