Warren Buffett’s net worth has grown 25% annually for 72 years.

He’s the best investor to ever live.

And it’s not close.

He started out buying egregiously cheap shares in tiny businesses. Later, he would buy small stakes in larger businesses. And later still, he would swallow entire companies. In the beginning, it was Greif Brothers Cooperage and Western Insurance. Now it’s BNSF and Apple.

But through the years, one opportunity set persisted.

Arbitrage.

“While at Graham-Newman, I made a study of its earnings from arbitrage during the entire 1926-1956 lifespan of the company. Unleveraged returns averaged 20% per year. Starting in 1956, I applied Ben Graham’s arbitrage principles, first at Buffett Partnership and then Berkshire. Though I’ve not made an exact calculation, I have done enough work to know that the 1956-1988 returns averaged well over 20%.” - Warren Buffett

Today, we’ll dive deep into one of Buffett’s arbs.

My friend, Turtle Bay, has the best data on old investments. He has terabytes worth of Buffett history. We teamed up to write this article. If you like it, we’ll do more in the future.

If these case studies work as intended, we can all learn something together.

“Give a man a fish and you will feed him for a day. Teach a man to arbitrage and you will feed him forever.” - Warren Buffett

(This post was originally released in September 2024. I’ve decided to remove the paywall so folks can see the full case study. It’s one of my favorite Buffett stories.)

Arcata Corp.

It’s 1981.

The United States is muddling through a recession. Inflation is ripping. Interest rates are climbing. It’s tough out there.

While America slogs along, Warren Buffett gets richer by the day. Just 4 years ago Buffett’s net worth was $67MM. Now that number is rapidly hurdling toward $350MM.

A new boom is afoot. Leveraged buyouts are taking a grip on public markets. Transactions financed almost entirely with debt provide the opportunity for high returns to equity holders. Companies are being taken out of public markets with premium bids coming from private equity funds.

No firm is more synonymous with the LBO boom than Kohlberg Kravis Roberts, Inc. (KKR).

And that’s where our story begins.

Situation Overview

The history of Arcata dates back to 1905 when a group of investors purchased approximately 20,000 acres of redwood timberlands in Humbolt County, CA.

By 1981, Arcata was the second largest printing services organization in the U.S. In addition, Arcata owned 77,500 acres of Northern California timberlands, which it used for timber harvesting, reforestation and milling.

Arcata was to be acquired by KKR. The stock was trading around $33/share at the time of the deal announcement. KKR’s $37 offer represented a reasonable premium over the current share price. But there was one other interesting bit of information.

“In 1978 the U.S. Government had taken title to 10,700 acres of Arcata timber, primarily old-growth redwood, to expand Redwood National Park. The government had paid $97.9 million, in several installments, for this acreage, a sum Arcata was contesting as grossly inadequate. The parties also disputed the interest rate that should apply to the period between the taking of the property and final payment for it. The enabling legislation stipulated 6% simple interest; Arcata argued for a much higher and compounded rate.” - Warren Buffett

“Buying a company with a highly speculated, large-sized claim in litigation creates a negotiating problem, whether the claim is on behalf of or against the company. To solve this problem, KKR offered $37.00 per Arcata share plus two-thirds of any additional amounts paid by the government for the redwood lands.” - Warren Buffett

Buffett Gets to Buying

Berkshire began buying shares on September 30th. Over the course of 8 weeks, Buffett bought 5% of Arcata.

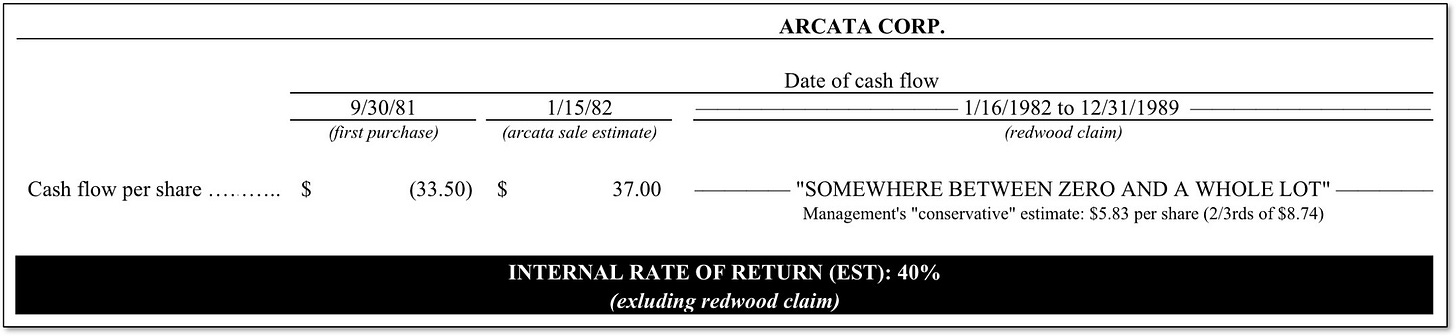

“We started buying Arcata stock, then around $33.50, on September 30 and in eight weeks purchased about 400,000 shares, or 5% of the company. The initial announcement said that the $37.00 would be paid in January 1982. Therefore, if everything had gone perfectly, we would have achieved an annual rate of return of about 40% — not counting the redwood claim, which would have been frosting.” - Warren Buffett

“All did not go perfectly. In December it was announced that the closing would be delayed a bit. Nevertheless, a definitive agreement was signed on January 4. Encouraged, we raised our stake, buying at around $38.00 per share and increasing our holdings to 655,000 shares, or over 7% of the company. Our willingness to pay up - even though the closing had been postponed - reflected our leaning toward ‘a whole lot’ rather than ‘zero’ for the redwoods.” - Warren Buffett

The Deal Takes a Turn

“Then on February 23, the lenders said they were taking a ‘second look’ at the financing terms ‘in view of the severely depressed housing industry and its impact on Arcata’s outlook.’ The stockholders’ meeting was postponed again, to April. An Arcata spokesman said he ‘did not think the fate of the acquisition itself was imperiled.’ When arbitrageurs hear such reassurances, their minds flash to the old saying: ‘He lied like a finance minister on the eve of a devaluation.’” - Warren Buffett

“On March 12, KKR said its earlier deal wouldn’t work, first cutting its offer to $33.50, then two days later raising it to $35.00. On March 15, however, the directors turned this bid down and accepted another group’s offer of $37.50 plus one-half of any redwood recovery.” - Warren Buffett

The Deal Closes

On June 4th, the Arcata deal closed. Berkshire made $1.7MM instantly, earning a 15% annualized return.

Settling the Redwood Claim

So, Buffett recouped his investment plus a tidy profit in less than nine months. At this point he’s playing with house money. There was another small payment of $0.65/share received in September 1983 related to the Redwood payout.

As we turn our eye toward the value of the Redwood claim there are two pieces of data to consider:

Value of Timberland Taken: The U.S. government had paid $97.9MM for the timberlands. Arcata, using prior property seizures, court precedents and the work of valuation experts determined it should be owed $215MM plus market interest.

Interest Rate Applied to Payments: At the time, the federal government allowed for 6% simple interest. Arcata argued for market interest rates, on a compound basis.

So how did it work out?

“The trial judge appointed two commissions, one to look at the timber’s value, the other to consider the interest rate questions. In January 1987, the first commission said the redwoods were worth $275.7 million and the second commission recommended a compounded, blended rate of return working out to about 14%.” - Warren Buffett

“In August 1987 the judge upheld these conclusions, which meant a net amount of about $600 million would be due Arcata. The government then appealed. In 1988, though, before this appeal was heard, the claim was settled for $519 million. Consequently, we received an additional $29.48 per share, or about $19.3 million. We will get another $800,000 or so in 1989.” - Warren Buffett

The final result: 39% IRR.

Lessons Learned

So there you have it. The greatest investor to ever live earns a 39% IRR in a low-risk arb deal. The most striking part of this case is not the return generated - but the lack of risk taken.

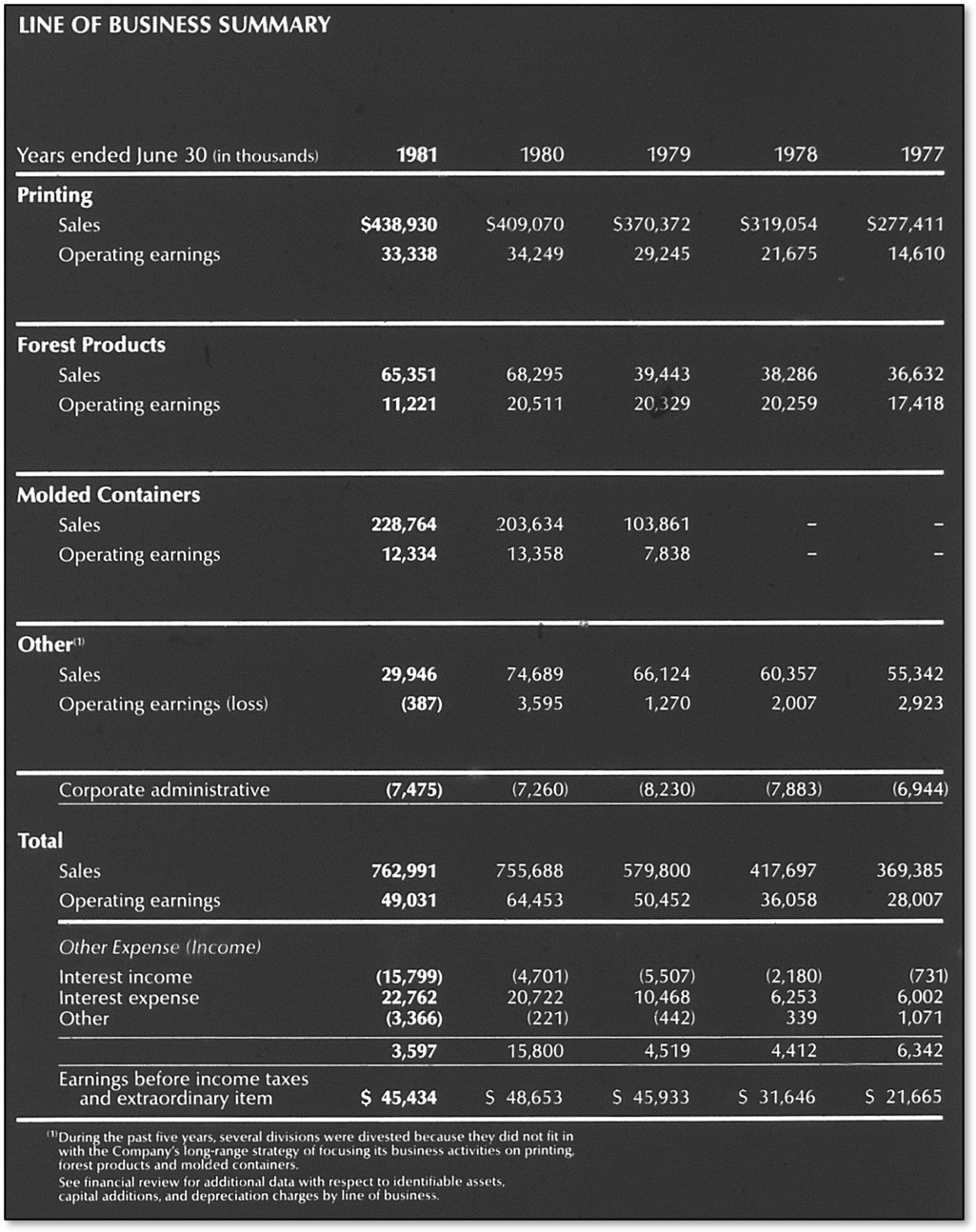

Arcata was a profitable, growing business. Take a look at its five-year history leading up to the deal.

Arcata had strong operating businesses that earned sufficient sums to cover its interest burden with plenty of comfort.

The stock was trading at ~10x earnings, an inexpensive price over the long run. And this excludes any future earning potential from the redwood claim. If the deal had been called off, and the redwood claim amounted to zero additional income, the stock still wouldn’t be overvalued.

Buffett understands human psychology. Once you’ve made the public declaration to sell your business, you’re not likely to back away from that path. Corporate actions often take monumental effort. Once you announce a deal, every psychological and economic force pushes you further down the path you’ve chosen.

Remember, Buffett says: “Arcata’s management and directors had been shopping the company for some time and were clearly determined to sell.”

It shouldn’t come as a surprise that the deal was struck above Buffett’s initial purchase price. Within 9 months, the Oracle had his principal back plus a tidy profit.

He’d handicapped the likelihood of further payment for the redwood claim. Apparently, he decided he liked the odds. But again, there was no capital at play - he was taking virtually no risk.

The Arcata deal illustrates Buffett’s margin of safety in a way that’s different than what we’d normally consider. It’s a masterclass in situational awareness, probabilistic thinking and shrewd handicapping.

It’s not an example you’d see in a finance textbook. It’s something much more real.

It’s Buffett’s razor-sharp intellect playing with intense focus and a stacked deck.

It’s Buffett in his finest form.

DISCLOSURE: THIS IS NOT INVESTMENT ADVICE. I MAY OWN THESE SECURITIES. I MAY BUY OR SELL THESE OR ANY OTHER SECURITIES AT ANY TIME. I MAY NOT TELL YOU IF AND WHEN I BUY OR SELL. THESE STOCKS MAY BE ILLIQUID AND YOU SHOULD UNDERSTAND THE IMPLICATIONS OF THAT IF YOU BUY THEM. THIS IS NOT TAX, LEGAL OR FINANCIAL ADVICE. I AM NOT YOUR FIDUCIARY. THIS IS THE INTERNET AND YOU’RE LISTENING TO A GUY NAMED DIRT.